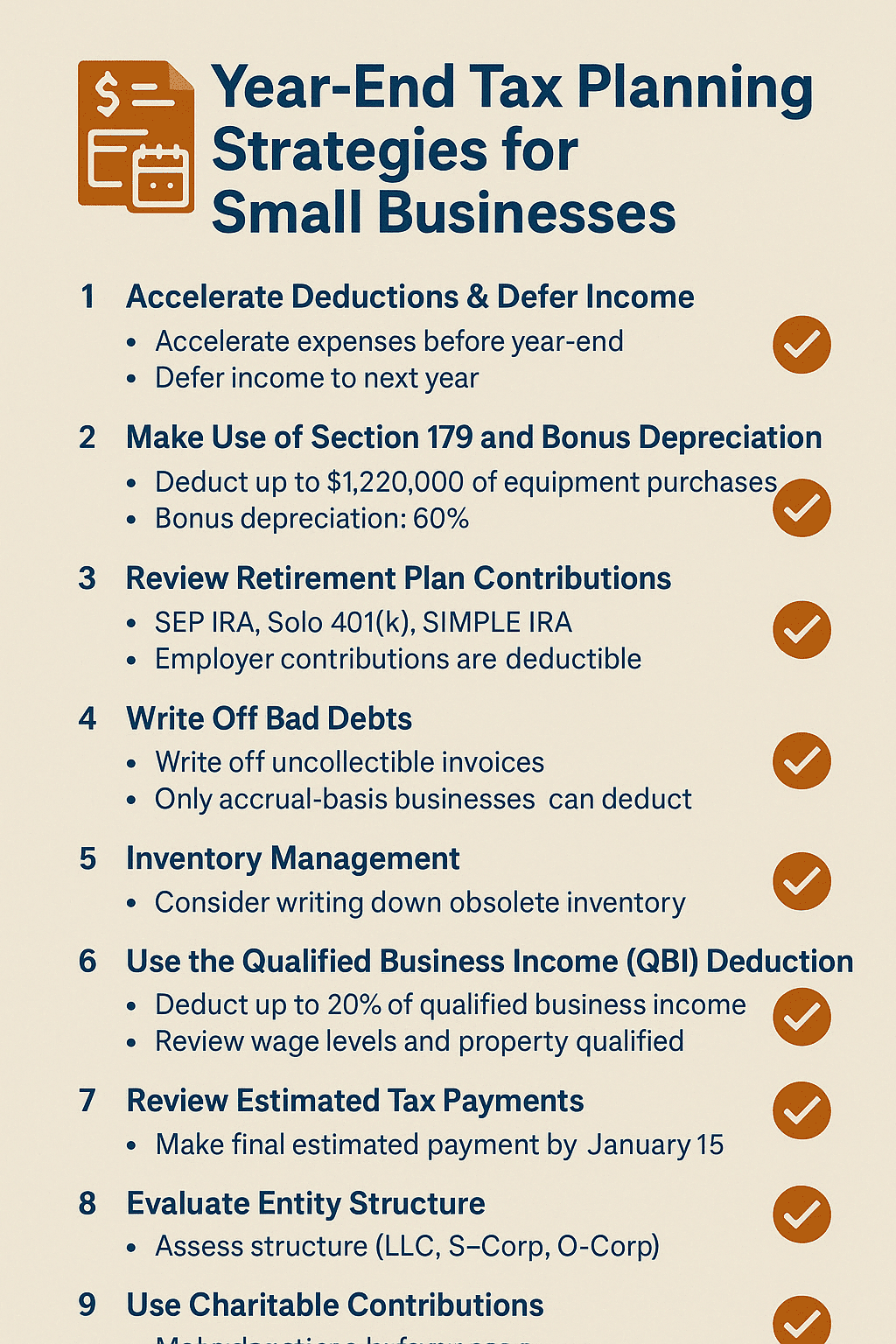

1. Accelerate Deductions & Defer Income

- Accelerate expenses such as vendor payments, office supplies, bonuses, or equipment purchases before December 31.

- Defer income by delaying invoicing until the next year, where feasible, to reduce current year taxable income.

- Best for cash-basis taxpayers.

- Applies to machinery, computers, office furniture, and certain improvements.

- 2024 Solo 401(k) contribution limit: up to $69,000 (with catch-up if age 50+).

- Only accrual-basis businesses can deduct bad debts.

- Perform physical inventory count and reconcile with accounting records.

- Review wage levels and qualified property to maximize deduction.

- Switching to an S-Corp may save on self-employment taxes.

- Keep acknowledgment letters for contributions over $250.

- This ensures compliance, maximizes deductions, and avoids costly errors.

2. Make Use of Section 179 and Bonus Depreciation

Under Section 179, businesses can deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year, up to the IRS-set limits.

- 2024 Section 179 limit: $1,220,000

- Bonus depreciation: 60% (phase-down from 100%)

3. Review Retirement Plan Contributions

Contribute to tax-advantaged retirement plans like:

- SEP IRA (for self-employed)

- Solo 401(k)

- SIMPLE IRA

Employer contributions are tax-deductible and help reduce taxable income.

4. Write Off Bad Debts

Review your accounts receivable and write off any uncollectible invoices. This reduces income and improves your balance sheet.

5. Inventory Management

Conduct a year-end inventory review. Consider writing down obsolete or unsellable inventory, which can be deducted from taxable income.

6. Use the Qualified Business Income (QBI) Deduction

Eligible businesses (sole proprietorships, partnerships, S-corps) can deduct up to 20% of qualified business income under Section 199A.

7. Review Estimated Tax Payments

Ensure all quarterly estimated payments are made accurately to avoid underpayment penalties. Consider making a final estimated payment by January 15 if you’re falling short.

8. Evaluate Entity Structure

A year-end review is a great time to assess whether your current business structure (LLC, S-Corp, C-Corp) is still optimal for your income level and growth.

9. Use Charitable Contributions

Donations to qualified nonprofits are tax-deductible. Consider cash donations, equipment, or inventory gifts before December 31.

10. Consult a Tax Professional

A tax advisor can help you analyze your financials, project your tax liability, and implement tailored strategies before year-end.

📊 Final Thoughts

Year-end tax planning is not just about minimizing taxes—it’s about maximizing opportunities. With careful review and timely actions, small businesses can reduce tax liability, improve cash flow, and start the new year on a strong financial footing.

Don’t wait until the last week of December—start planning now for a smarter tax season.